Trump’s global tariff shock may appear chaotic and reckless, but there’s historical precedent for such disruptive policies yielding long-term strategic gains for the U.S.

Key Highlights:

1. The Shock:

- Trump imposed a minimum 10% tariff on all US trade, with much higher rates for key partners (25% on allies like Japan and South Korea; 45%+ on nations like Vietnam).

- Global markets reacted sharply—stocks tumbled, political backlash surged, and China retaliated with 34% tariffs, signaling a brewing trade war.

- The move has disrupted global supply chains and threatens debt crises in export-dependent countries.

2. Strategic Intentions Behind the Chaos:

- Despite Trump’s erratic image, his advisers are pursuing a calculated economic reset:

- Scott Bessent speaks of a “global economic reordering.”

- Stephen Miran’s paper outlines a strategy using tariffs and financial pressure (e.g., leveraging US debt holdings) to extract concessions.

- The goal is to force allies and rivals to renegotiate trade and debt relationships, keeping the dollar dominant while reviving US manufacturing.

3. Historical Analogy – The Volcker Shock (1979–1983):

- Paul Volcker’s interest rate hikes caused a brutal recession, surging unemployment, and collapsed manufacturing.

- But by 1983, inflation had plummeted and a new financialized US economy emerged.

- The global economic order realigned around the US, setting the stage for decades of credit-fueled globalization.

4. What Might Happen Now:

- The current tariff shock could have similar long-term effects: triggering a painful transition but potentially reinforcing US hegemony.

- Countries like Vietnam have already begun capitulating, and the US’s structural power as a massive consumer and debtor gives it serious leverage.

- However, China remains the true test—whether it will bend or escalate remains to be seen.

Takeaways:

- Trump’s approach might work, not because it’s well-designed, but because of the asymmetry of global dependence on the US economy.

- The Volcker precedent shows how economic trauma can lead to a new global order—one that serves US interests.

- Even if it fails, the global economic landscape is unlikely to revert to its previous status quo.

Bottom Line:

Trump’s economic shock strategy may seem irrational, but it taps into a brutal logic of power politics in trade. If successful, it could rewrite the rules of globalization—not in spite of the chaos, but because of it.

Would you like a summary in bullet points, a simplified version for general audiences, or a visual infographic to explain this further?

4o

You said:

please add bullet points and a visual infographic to explain this further

ChatGPT said:

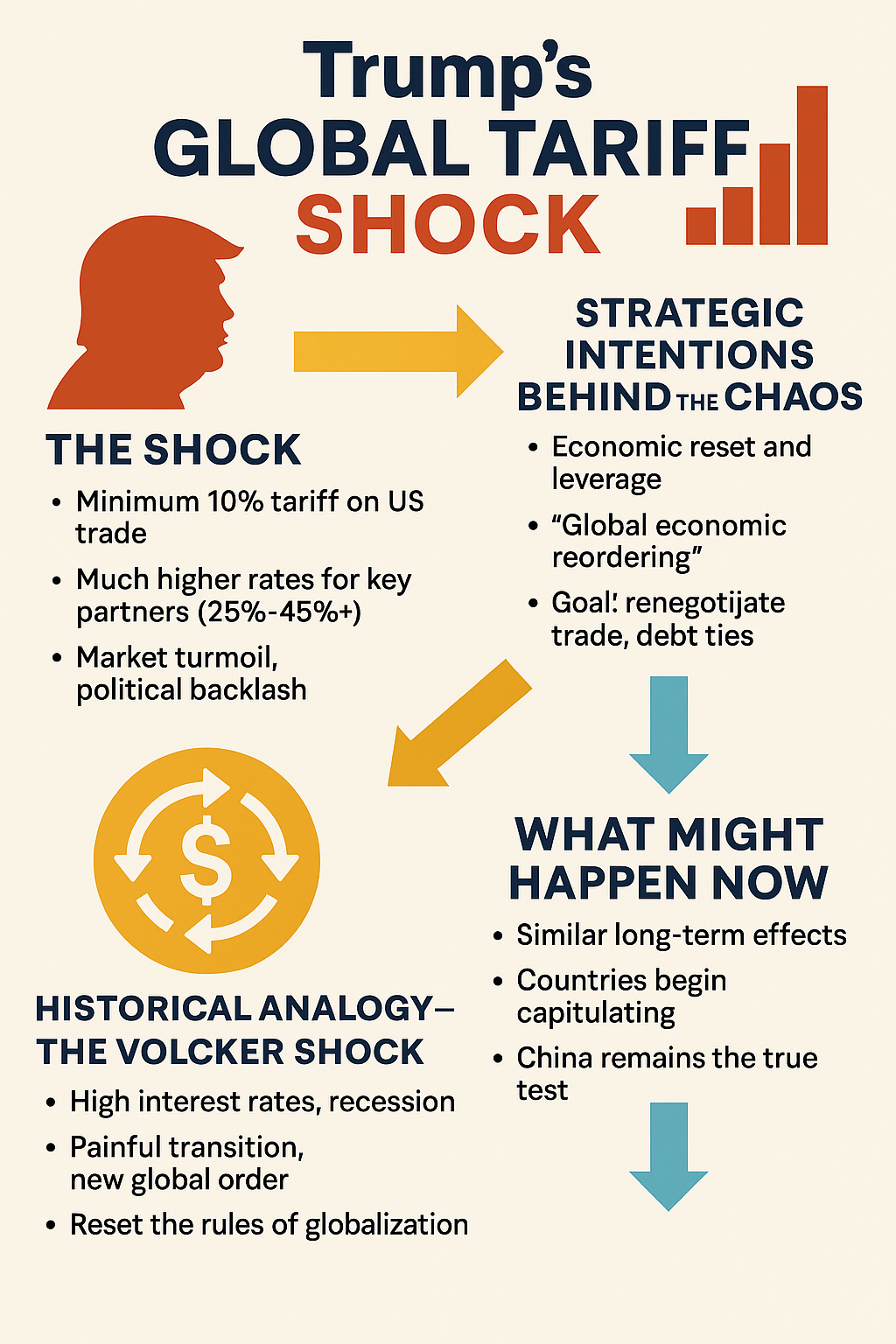

Here’s a bullet-point summary of the key takeaways, followed by a visual infographic that helps illustrate the dynamics of Trump’s global tariff shock and its historical parallel to the Volcker shock.https://open.spotify.com/track/67td9oirHzw0Liv3UTGJTs?si=cdd72fb9a94743f5

🧠 Summary: Trump’s Global Tariff Shock Explained

🚨 What Happened

- Trump imposed a 10% minimum tariff on all trade with the US.

- Key partners like Japan, South Korea (25%), and Vietnam (45%+) hit hardest.

- Stock markets crashed, and China retaliated with 34% tariffs.

- Risk of a new global debt crisis due to lost export earnings in developing economies.

🧠 Strategic Thinking Behind the Chaos

- Despite Trump’s reputation, his advisors are executing a coordinated plan:

- Restructure the global trade system in favor of US interests.

- Use tariffs and financial leverage (e.g., US debt holdings) to extract concessions.

- Target: weaken Chinese influence while preserving US dollar dominance.

📜 Historical Precedent: The Volcker Shock (1979–1983)

- Interest rates raised to 19% to kill inflation.

- Caused massive recession and global debt crises.

- But: US inflation fell, and a new finance-led economy emerged.

- Set the stage for US-led globalization, with the US as importer and debtor-in-chief.

🔮 What’s at Stake Now

- Vietnam and other countries already offering concessions.

- Trump administration expects more nations to negotiate under pressure.

- China is the key player—outcome hinges on its response.

- This could reshape the world economy, like Volcker’s shock did.

📊 Infographic: Trump’s Tariff Shock vs. Volcker’s Interest Rate Shock